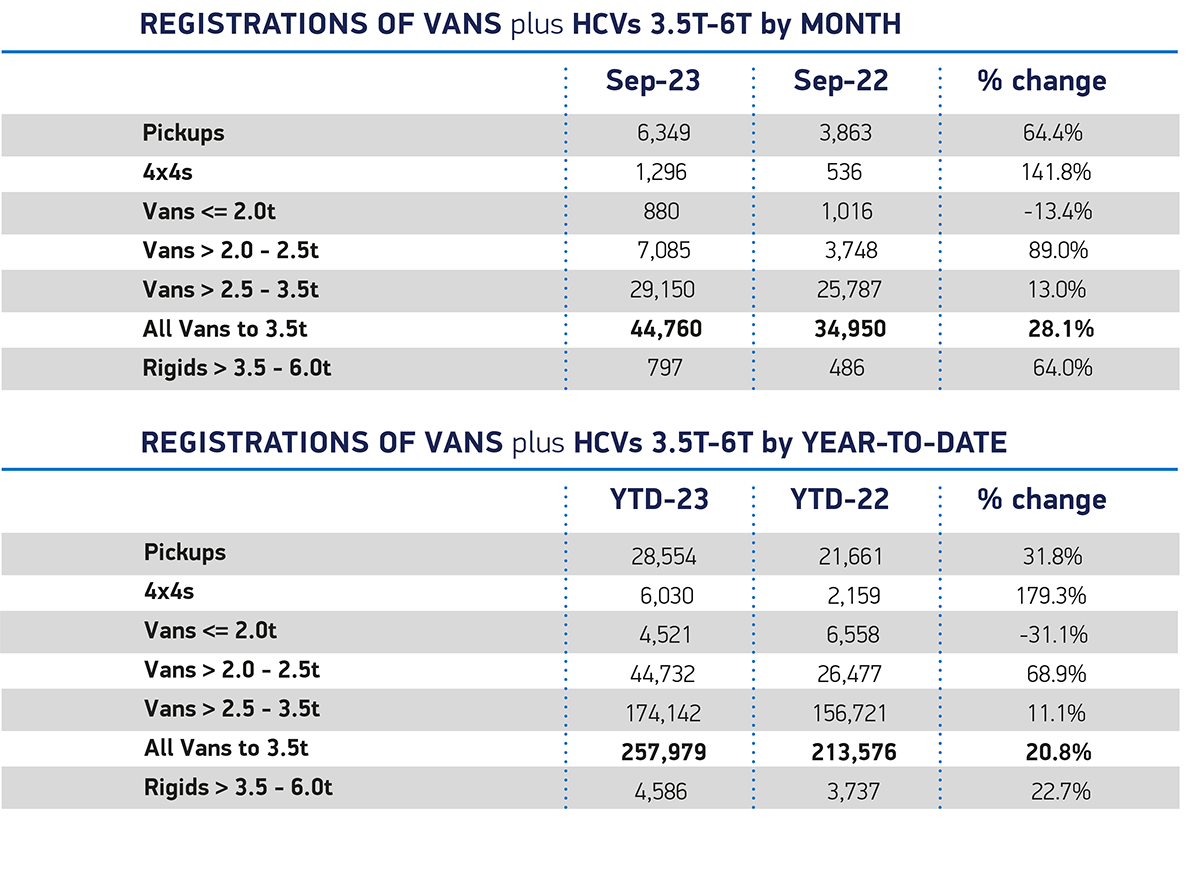

The UK’s Light Commercial Vehicle (LCV) market grew 28.1% in September, marking the ninth month of continuous growth for the sector. 44,760 vans and pickups (up to 3.5t) were registered last month according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT).

September is historically a strong month for new van registrations, due to the new registration plate release, and the month made a large contribution to the 20.8% year-to-date increase over the 2022, with 257,979 units registered in the first nine months of 2023.

Large vans remain the preference for buyers, with the greater share of registrations going to vans between 2.5t and 3.5t. 29,150 vans in this category were registered in September 2023, an increase of 13% over 2022.

Medium van registrations (between 2t and 2.5t) nearly doubled year-on-year, going form 3,748 in September 2022, to 7,085 in September 2023, an increase of 89%. While small van registrations declined, reducing from 1,016 in September 2022 down to 880 in September 2023.

Electric vehicle uptake remains slow, though this was a much stronger month in that regard. Year-on-year, electric van registrations increased from 1,550 in September 2022 to 2,882 in September 2023. While this was an increase of 85.9%, it was only 1,332 additional vehicles. This has increased the market share to 6.4%, which brings the year-to-date market share for electric vans to 5.5%.

Mike Hawes, SMMT Chief Executive, said: “Vans are irreplaceable workhorses that keep Britain on the move, so a bumper September capping nine months of growing fleet renewal is good news for the economy, the environment and society. Decarbonising this sector is fundamental to the wider net zero transition and, as vans are business critical, urgent measures are needed to grow operator confidence to invest now, in 2024 and beyond. In particular, the specific needs of van operators must be considered when planning public charging strategies.”

Demand for electric vans is increasing, albeit slowly, due to increased choice and more competitive running costs when compared to diesel. However, we are still seeing slower uptake due to the lack of a clear national plan to develop charging infrastructure that is suitable for vans.