The UK light commercial vehicle (LCV) market has grown for the sixth consecutive month in June, marking the best monthly, and yearly, result since 2019.

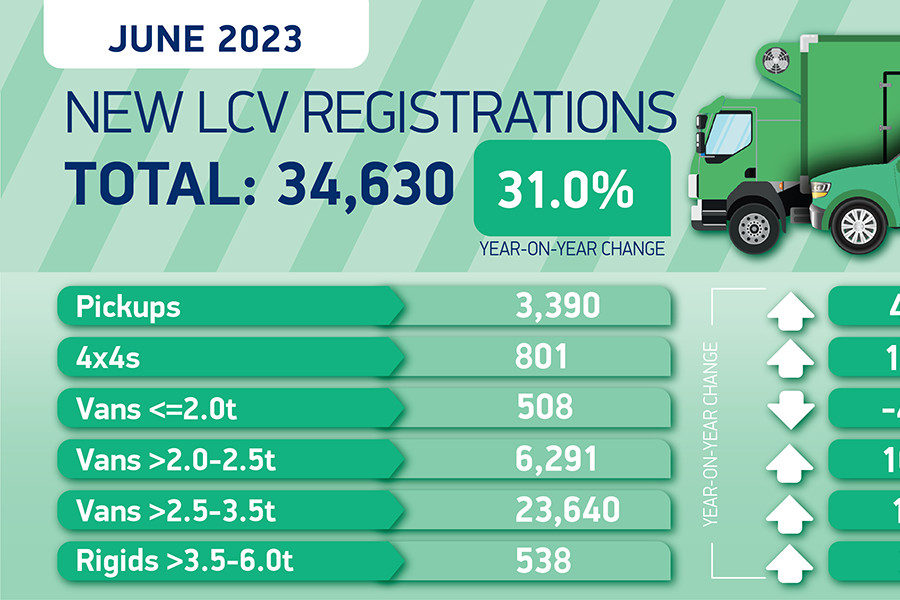

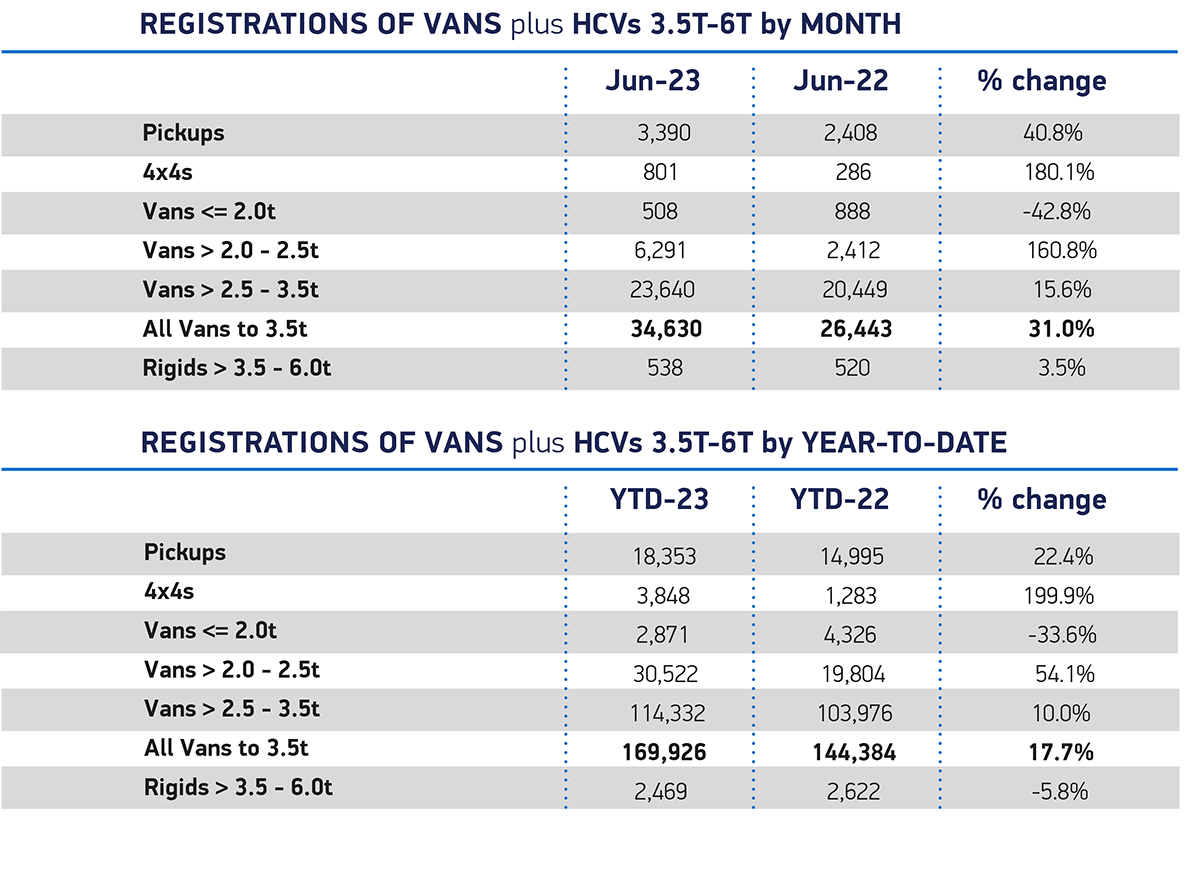

According to figures published by the Society of Motor Manufacturers and Traders (SMMT), there were 34,630 new LCV registrations in June, an increase of 31% over the previous June.

Year-to-date, new LCV registrations increased by 17.7%, from 144,384 to 169,926 for the first six months of the year.

The SMMT cite the easing of supply chain shortages as one of the leading reasons for the increase in registrations, allowing manufacturers to begin to return to pre-pandemic production levels.

Most of the June year-on-year increase was down to vans between 2.0t and 3.5t, with over 7,000 more units registered in this category than June 2022.

Looking at the year-to-date figures, there is a similar emphasis on vans between 2.0t and 3.5t, with most of the increase down to the additional 20,000 vans registered in this category in 2023 compared to 2022.

Small vans, categorised as less than 2.0t gross vehicle weight, had fewer registrations than 2022. Year-on-year for June showed a reduction of 42%, down from 888 in 2022 to 508 in June 2023. Year-to-date, small van registrations dropped from 4,326 in 2022, to 2,871 in 2023, a drop of 34%

The SMMT assign much of the drop in small LCV registrations to a drop in demand, as operators turn to larger vehicles to improve cost-effectiveness.

June was a poor month for battery electric vans (BEVs), with registrations falling 12% from 2,015 in June 2022 to 1,775 in June 2023. Year-to-date, BEV registrations are up 8.7%, though market share has dropped slightly.

One of many reasons for the drop in BEV registrations remains the difficulty in finding suitable and local charging points. Charge point operators are looking to invest and improve the charging network, but are encountering obstacles such as an outdated planning system and delays to grid connections. These issues must be resolved if a capable charging infrastructure is to be built.

Mike Hawes, SMMT Chief Executive, said, “As we reach the year’s midway mark, the surge in light commercial vehicle registrations is good news and delivers continued optimism to the market. The fall in electric van uptake just at the time when we need it to grow is, however, very concerning. Despite the continued availability of the plug-in van grant, more needs to be done to give operators the confidence to make the switch. This means a long-term plan which supports purchase and helps overcome some of the barriers to the installation of van-suitable charging infrastructure, given the unique needs of this sector.”

Van Ninja continues to see strong interest for small van leasing, which seems contrary to the SMMT’s report, but these small vans are in short supply. Van Ninja does continue to hold a number of small, medium, and large vans in stock for leasing, which can be found on the In Stock page of the website.